Ready to use MIS Tools for Business Growth

Choose the best tool required for your business to boost your productivity and efficiency. We are introducing MIS tools for VAT, TDS, Payroll, Projection, Small Business Accounting and many more.

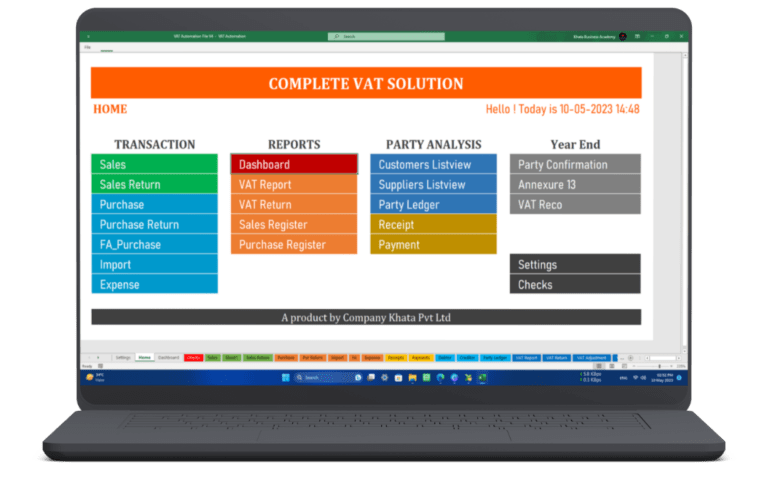

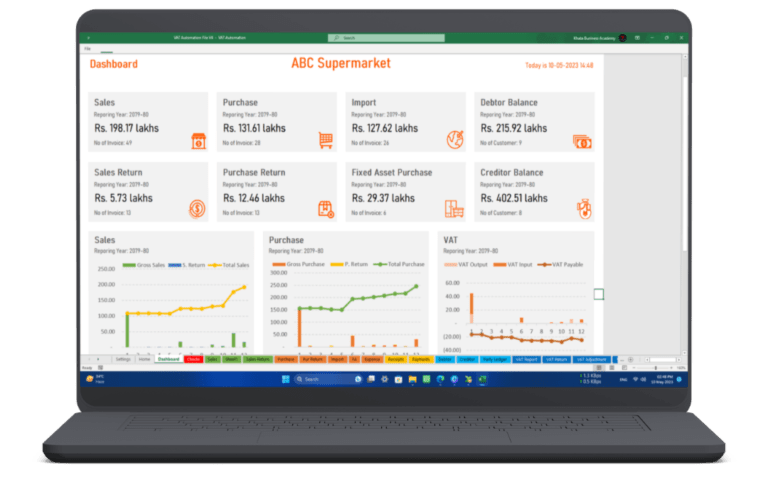

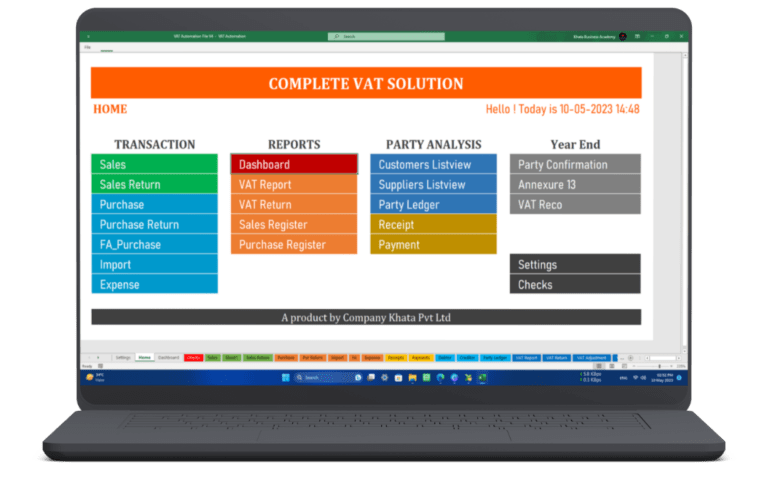

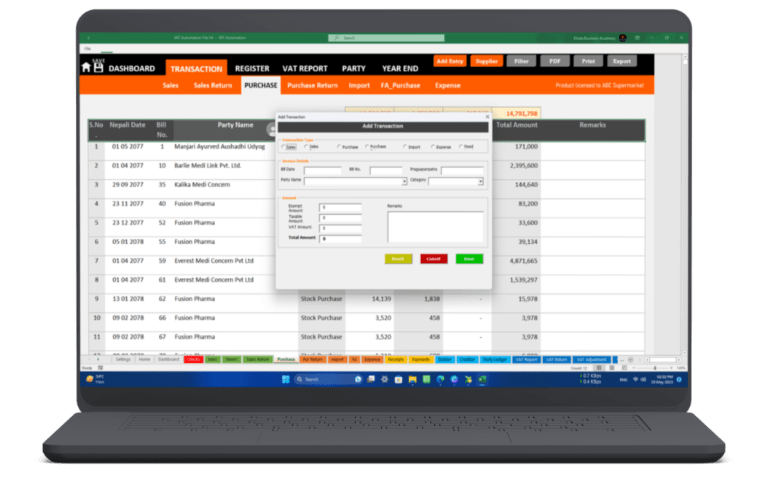

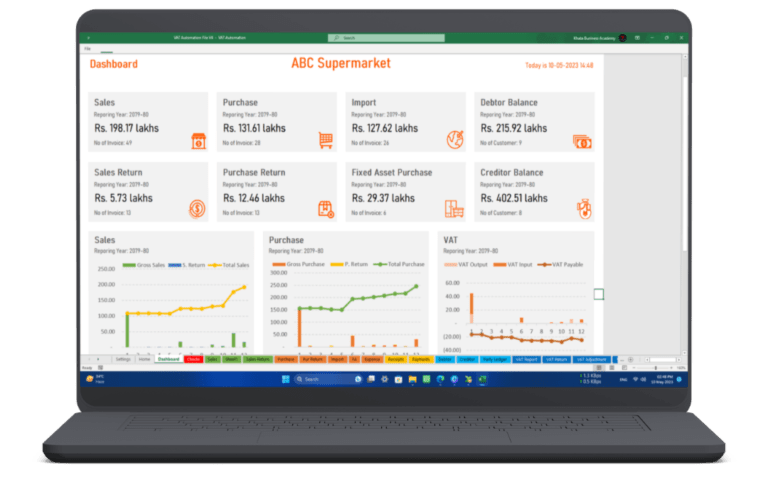

VAT MIS

Easily record transactions, prepare summaries, file returns and track party ledgers with our VAT MIS Tool

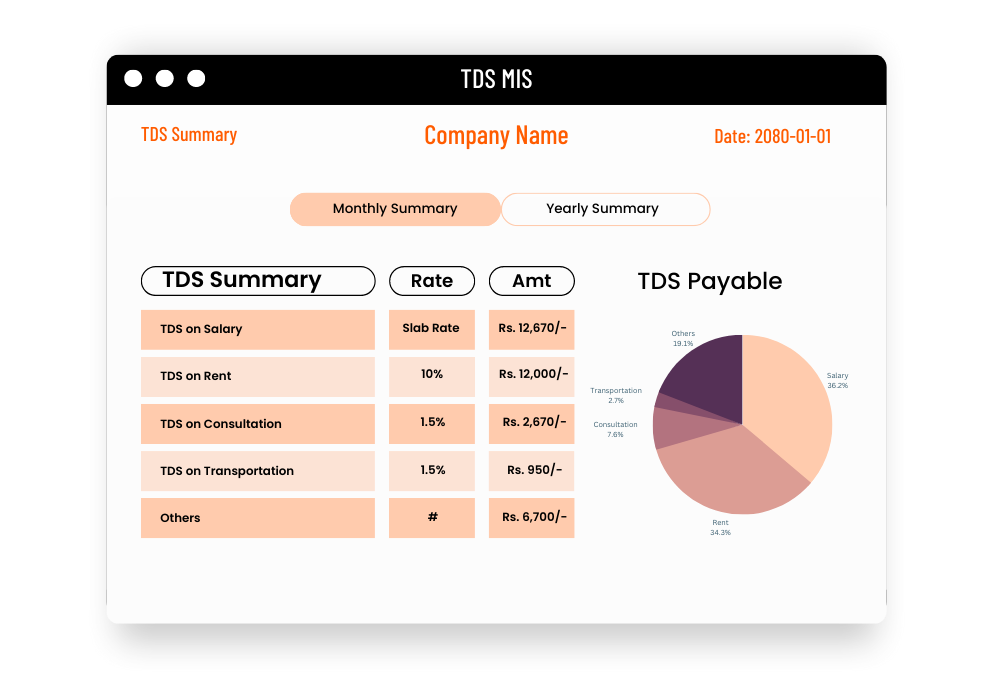

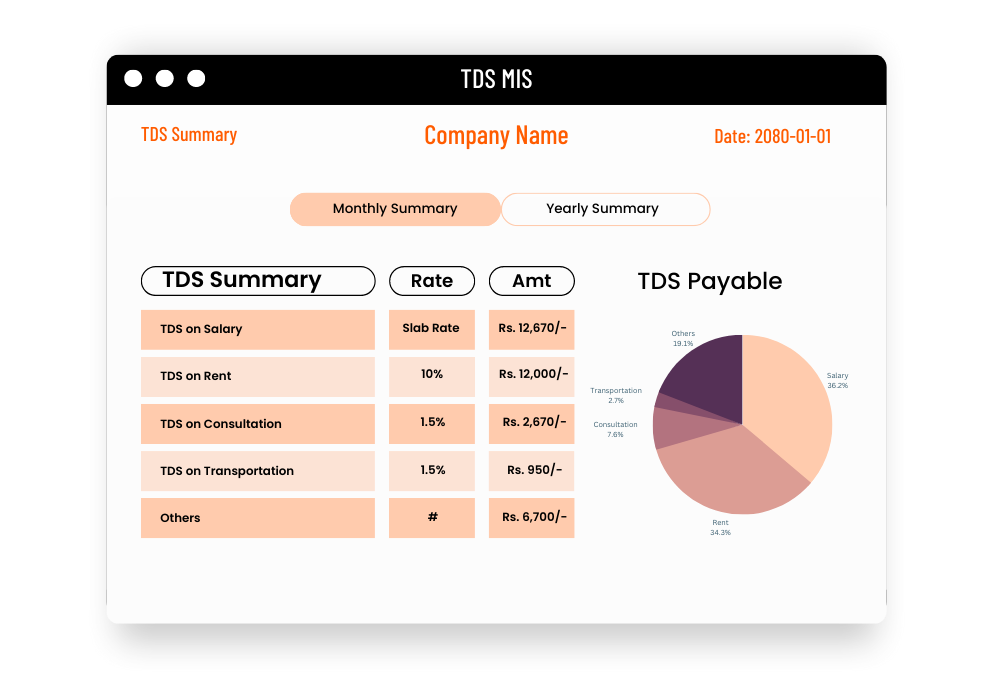

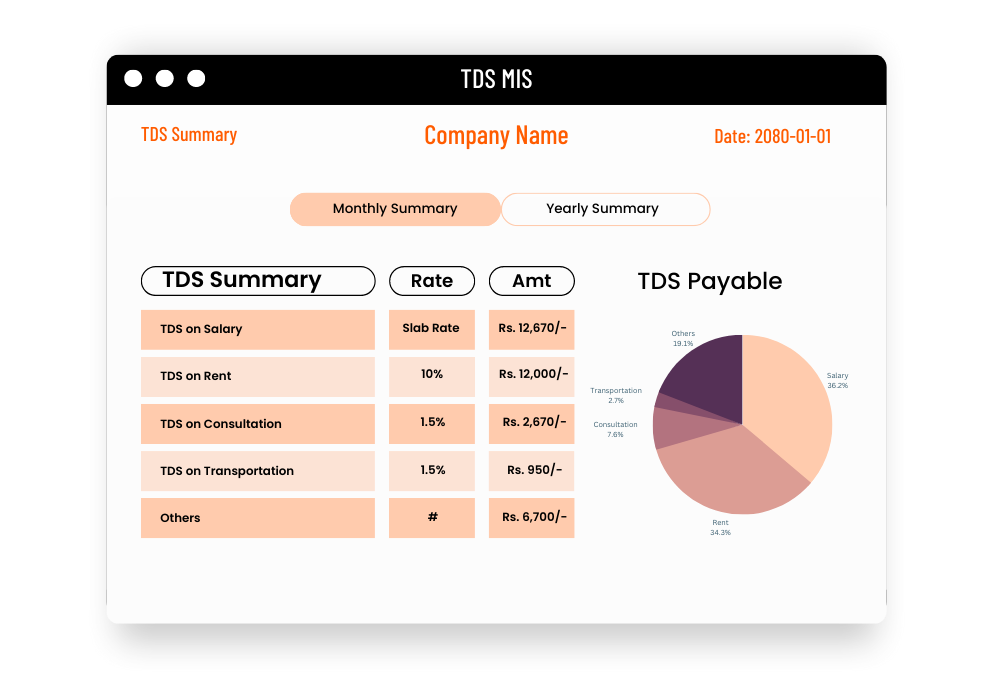

TDS MIS

Identify TDS applicable transactions, deduct the amount and record ETDS filing in our TDS MIS Tool

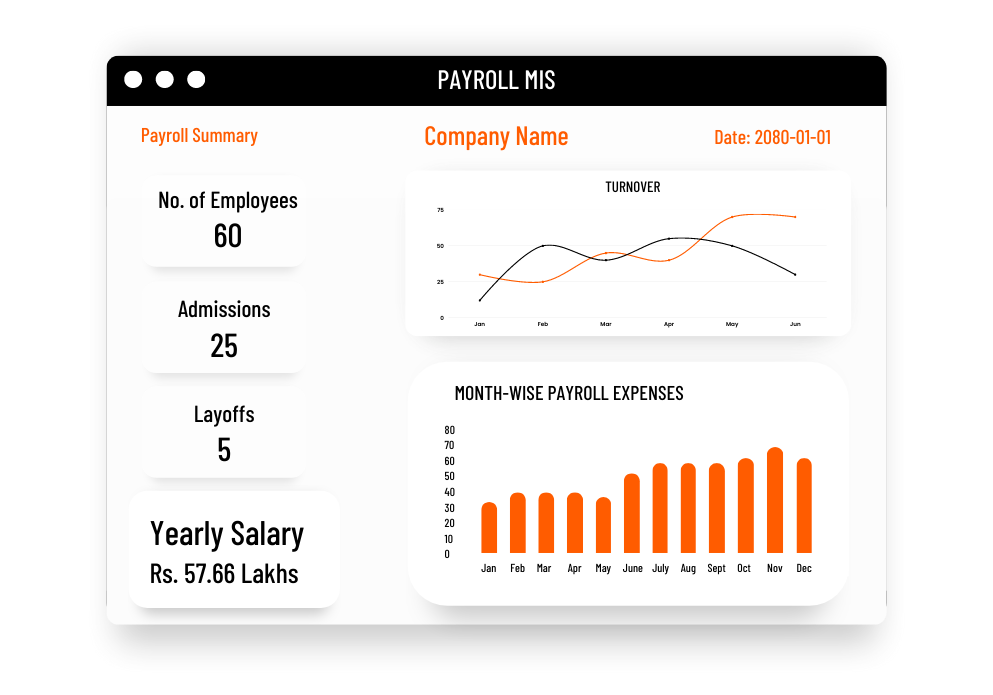

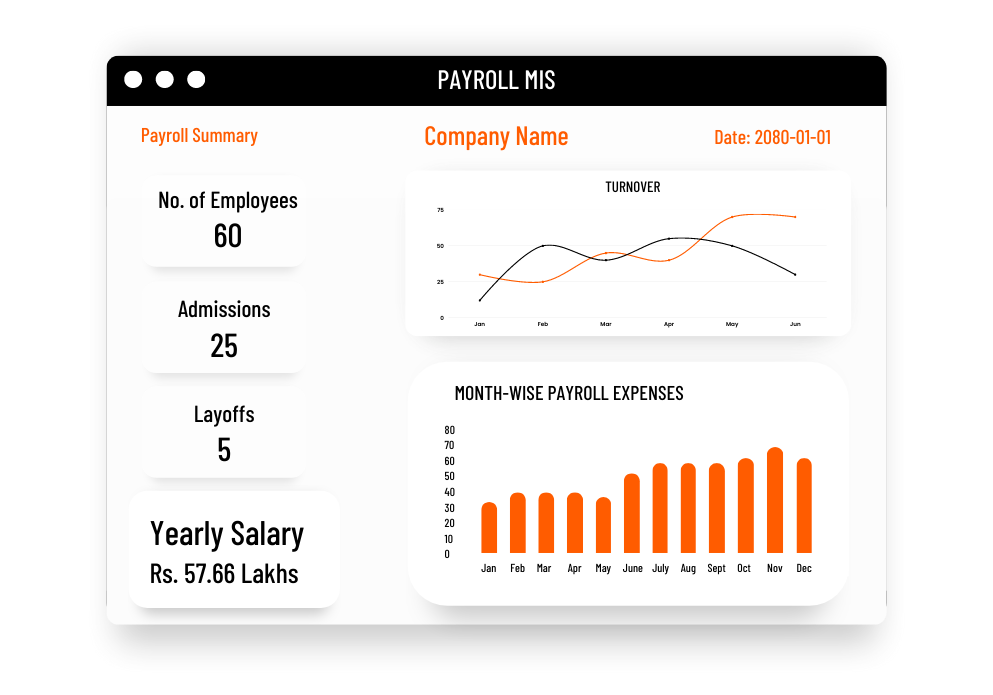

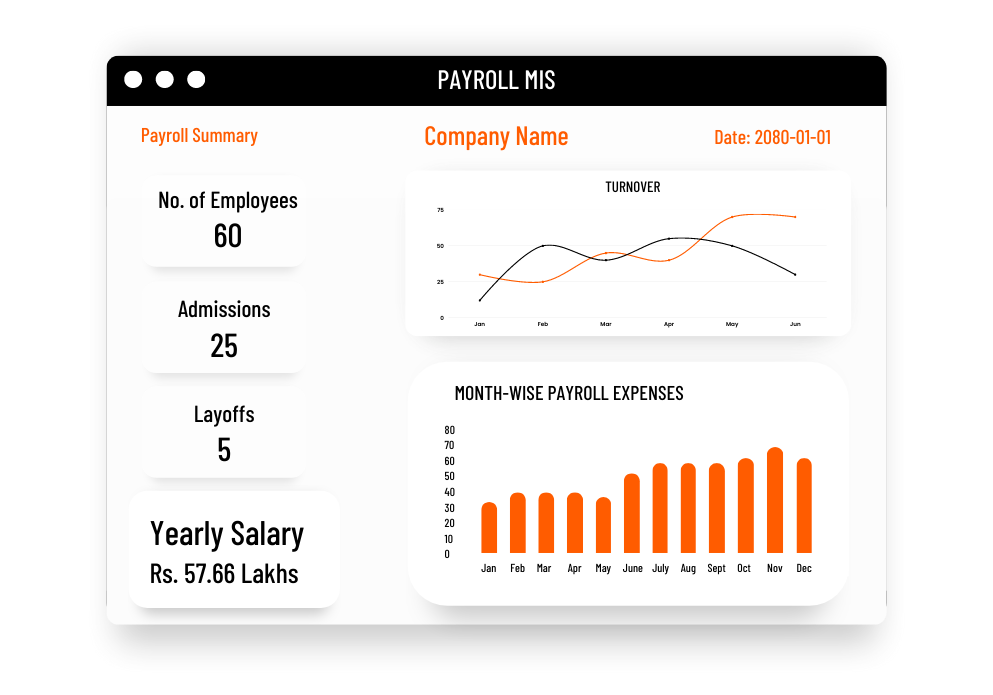

PAYROLL MIS

Tracking workdays and salary, fix the allowances, deduct PF/SSF and calculate SST & TDS from our Payroll MIS

PROJECTION MIS

Prepare a Financial Projection of your businesses mostly used for banking and financial purposes using our data sheet and index templates.

ACCOUNT REPORTING

Preparation of Balance Sheet, Profit & Loss Accounts and Cash Flow Statement will no longer be a hassle for your business.

INVENTORY MIS

Manage your opening stock, purchase, import and sales quantity to get a clear picture of real time closing stock available in your business.

Easily record transactions, prepare summaries, file returns and track party ledgers with our VAT MIS Tool

Identify TDS applicable transactions, deduct the amount and record ETDS filing in our TDS MIS Tool

Tracking workdays and salary, fix the allowances, deduct PF/SSF and calculate SST & TDS from our Payroll MIS

Prepare a Financial Projection of your businesses mostly used for banking and financial purposes using our data sheet and index templates.

Preparation of Balance Sheet, Profit & Loss Accounts and Cash Flow Statement will no longer be a hassle for your business.

Manage your opening stock, purchase, import and sales quantity to get a clear picture of real time closing stock available in your business.

Easy to Get Started

Standard Reporting Framework

Save a lot of Time and Effort

Choose The Micro-Applications According To Your Business Needs

Track TDS applicability, deduction, payment & return easily!

Available MIS

Financial Reports

Payroll

Financial Projections

Value Added Tax

Inventory Management

Tax Deducted at Source